Optimize Your Business With Efficient Self Storage Operating Expenses – Unlock Savings Today!

Understanding Self Storage Operating Expenses: A Comprehensive Guide

Introduction

Hello, storage aficionado! Welcome to our comprehensive guide on self storage operating expenses. In this article, we will delve into the various aspects of managing and optimizing the costs associated with operating a self storage facility. Whether you are a storage enthusiast looking to start your own business or a facility owner seeking to improve profitability, this guide is here to provide valuable insights and practical tips. So, let’s begin!

2 Picture Gallery: Optimize Your Business With Efficient Self Storage Operating Expenses – Unlock Savings Today!

Overview of Self Storage Operating Expenses

Before we dive into the specifics, let’s first understand what self storage operating expenses entail. These expenses encompass all the costs incurred in running a self storage facility, including but not limited to:

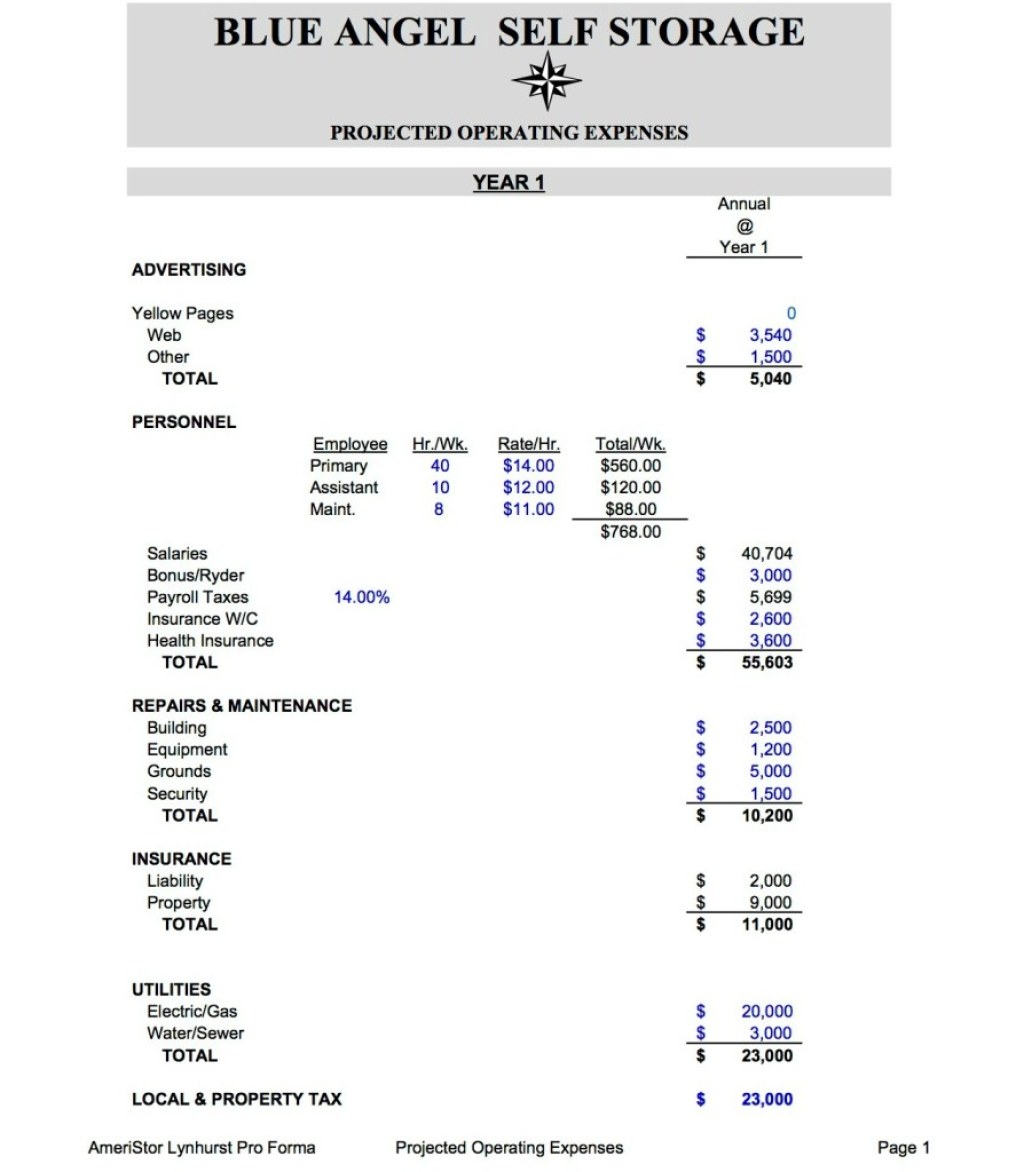

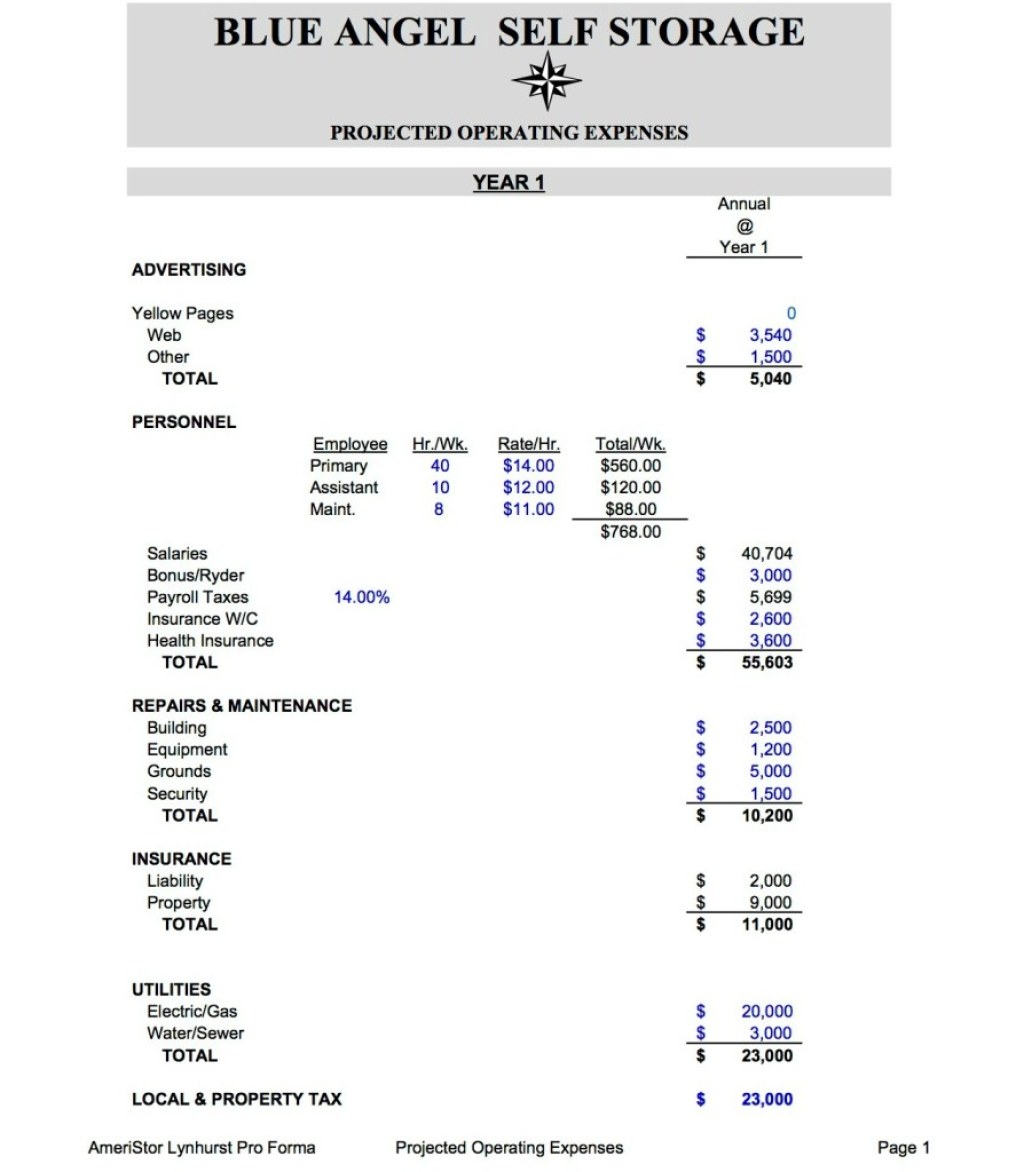

Image Source: creatingwealththroughselfstorage.com

Property taxes

Insurance premiums

Utilities (electricity, water, etc.)

Maintenance and repairs

Marketing and advertising

Employee salaries and benefits

Security measures

Now that we have a general idea of what self storage operating expenses include, let’s explore each aspect in detail.

What Are Self Storage Operating Expenses?

Image Source: creatingwealththroughselfstorage.com

🔍 Self storage operating expenses refer to the financial costs involved in managing and maintaining a self storage facility. These expenses can be categorized into various categories, including fixed expenses and variable expenses.

Fixed expenses, as the name suggests, are costs that remain relatively constant regardless of the facility’s occupancy. These expenses usually include property taxes, insurance premiums, and base utilities.

On the other hand, variable expenses are directly influenced by the facility’s occupancy and usage. These expenses may include utility bills that fluctuate based on consumption, marketing and advertising costs, and employee wages that vary with workload.

Who Is Responsible for Self Storage Operating Expenses?

🔍 The responsibility for self storage operating expenses lies with the facility owner or operator. As the owner, you are accountable for managing and optimizing these costs to ensure profitability and sustainable business growth.

It is essential to have a clear understanding of the expenses involved and implement effective strategies to control and reduce them whenever possible.

When Do Self Storage Operating Expenses Occur?

🔍 Self storage operating expenses occur on an ongoing basis throughout the operation of the facility. From the moment you open your doors to customers, you can expect these expenses to be incurred regularly.

Property taxes are typically levied annually, while insurance premiums may be paid monthly or annually depending on the policy. Utilities, maintenance, and employee salaries are recurring expenses that need to be budgeted for each month.

Where Can You Expect Self Storage Operating Expenses?

🔍 Self storage operating expenses can occur across various areas of your facility. Let’s take a closer look at some of the key areas where these expenses are typically incurred:

1. Property Taxes

Property taxes are a significant expense for self storage facilities. The exact amount varies depending on the location and size of the facility, as well as local tax rates. It is crucial to factor property taxes into your budget and plan accordingly.

2. Insurance Premiums

Insurance is vital to protect your facility and its contents from potential risks and liabilities. Premiums can vary based on factors such as coverage limits, deductible amounts, and the facility’s history of claims. Shopping around for competitive insurance rates can help minimize this expense.

3. Utilities

Utilities, including electricity, water, and gas, are essential for the day-to-day operation of your facility. Monitoring and optimizing energy consumption through energy-efficient practices can help reduce utility costs over time.

4. Maintenance and Repairs

Maintaining your facility in good condition is crucial for attracting and retaining customers. Regular maintenance and repairs, such as fixing roof leaks or repairing gates and doors, are necessary expenses to uphold the quality of your facility.

5. Marketing and Advertising

Effective marketing and advertising play a vital role in driving customer acquisition and retention. Allocating a budget for marketing strategies, both online and offline, can help raise awareness and generate leads for your facility.

6. Employee Salaries and Benefits

If you have employees working at your facility, their salaries and benefits contribute to your operating expenses. Hiring and retaining competent staff members is essential for providing excellent customer service and ensuring smooth operations.

7. Security Measures

Investing in security measures, such as surveillance systems, access controls, and alarms, is crucial for protecting your customers’ belongings and maintaining a safe environment. However, these security measures come with associated costs that need to be factored into your budget.

Why Are Self Storage Operating Expenses Important?

🔍 Understanding and effectively managing self storage operating expenses are crucial for the long-term success and profitability of your facility. Here are a few reasons why these expenses are essential:

1. Financial Stability and Profitability

By carefully monitoring and controlling your operating expenses, you can ensure financial stability and maximize profitability. When expenses are kept in check, you can allocate resources to areas that enhance customer experience and drive revenue.

2. Competitive Advantage

Controlling costs allows you to offer competitive rental rates and attract customers. By optimizing your operating expenses, you can provide value to customers while still maintaining healthy profit margins.

3. Sustainable Growth

Effective management of operating expenses enables sustainable business growth. By reducing unnecessary costs and allocating resources strategically, you can reinvest in the facility, expand your services, or explore new market opportunities.

How to Optimize Self Storage Operating Expenses?

🔍 Now that we understand the importance of optimizing self storage operating expenses, let’s explore some strategies to help you achieve cost-efficiency:

1. Conduct Regular Expense Audits

To identify potential areas for cost savings, conduct regular audits of your operating expenses. Review invoices, contracts, and service agreements to ensure you are getting the best value for your money.

2. Implement Energy-Efficient Practices

Reducing energy consumption not only benefits the environment but also lowers utility bills. Consider installing energy-efficient lighting, optimizing temperature control systems, and educating staff on energy-saving practices.

3. Negotiate Favorable Contracts

When renewing contracts with service providers, negotiate favorable terms and rates. Explore competitive options and leverage multiple bids to secure the best deals.

4. Embrace Technology

Investing in technology solutions can streamline operations and reduce costs. Utilize management software to automate administrative tasks, implement online rental processes to minimize paperwork, and leverage data analytics to make informed decisions.

5. Optimize Staffing Levels

Review your staffing needs regularly and ensure you have the right number of employees to efficiently manage your facility. Avoid overstaffing during low-demand periods and consider cross-training employees to handle multiple responsibilities.

FAQs about Self Storage Operating Expenses

1. Are self storage operating expenses tax-deductible?

🔍 While we are not tax advisors, it is generally recognized that many self storage operating expenses are tax-deductible. However, specific regulations may vary based on your location and the nature of your business. Consulting with a tax professional is recommended for accurate advice tailored to your situation.

2. Can I pass on operating expenses to my tenants?

🔍 In some cases, self storage facility owners may have the option to pass on a portion of operating expenses to tenants through rental rate adjustments or additional fees. However, it is essential to check local laws and regulations to ensure compliance and transparency in such practices.

3. How can I estimate my self storage operating expenses?

🔍 Estimating self storage operating expenses requires a thorough analysis of your facility’s specific needs and market conditions. Consult with industry experts, evaluate historical data, and consider benchmarking against similar facilities to develop accurate expense projections.

4. What are the most common mistakes to avoid when managing self storage operating expenses?

🔍 When managing self storage operating expenses, it is crucial to avoid common mistakes such as underestimating expenses, neglecting regular audits, failing to negotiate favorable contracts, overstaffing, and overlooking energy-efficient practices. Awareness and proactive management can help mitigate these mistakes.

5. Are there any industry benchmarks for self storage operating expenses?

🔍 Yes, there are industry benchmarks available for self storage operating expenses. These benchmarks provide insights into average expense ratios and can help you evaluate your facility’s performance. Industry associations and market research firms often publish reports that outline these benchmarks.

Conclusion

In conclusion, understanding and effectively managing self storage operating expenses are vital for the success of your facility. By optimizing these expenses, you can achieve financial stability, maintain a competitive edge, and foster sustainable growth. Implement the strategies outlined in this guide, regularly evaluate your expenses, and stay informed about industry best practices. By doing so, you will be well-equipped to navigate the financial aspects of running a self storage business.

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial or legal advice. Operating expenses may vary depending on factors such as location, facility size, and market conditions. It is recommended to consult with professionals and conduct thorough research specific to your situation when making financial decisions for your self storage business.

This post topic: Self Storage